This Post gives the details of Mumbai Mint UNC Set. For Proof Set refer to the Previous Post

For Hyderabad Mint UNC Sets refer to the next 2 posts.

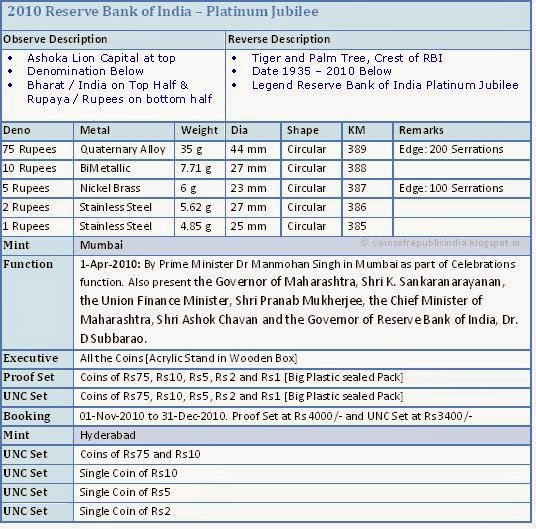

The Reserve Bank of India completed 75 years in 2010. To commemorate this occasion, a Proof set and UNC Set was issued. Apart from this circulation Coins of the Denomination Rs 10, Rs 5, Rs 2 and Rs 1 were also issued. The Rs 75 Coin was for the first time issued.

The details are;For Hyderabad Mint UNC Sets refer to the next 2 posts.

The Reserve Bank of India completed 75 years in 2010. To commemorate this occasion, a Proof set and UNC Set was issued. Apart from this circulation Coins of the Denomination Rs 10, Rs 5, Rs 2 and Rs 1 were also issued. The Rs 75 Coin was for the first time issued.

The Central Board of Directors is the main committee of the central bank. The Government of India appoints the directors for a four-year term. The Board consists of a governor, four deputy governors, four directors to represent the regional boards, and ten other directors from various fields. The central bank till now was governed by 21 governors. The 22nd, Current Governor of Reserve Bank of India is D. Subbarao

The main functions of the RBI are;

The main functions of the RBI are;Monetary authority

The Reserve Bank of India is the main monetary authority of the country and beside that the central bank acts as the bank of the national and state governments. It formulates, implements and monitors the monetary policy as well as it has to ensure an adequate flow of credit to productive sectors. Objectives are maintaining price stability and ensuring adequate flow of credit to productive sectors. The national economy depends on the public sector and the central bank promotes an expansive monetary policy to push the private sector since the financial market reforms of the 1990s.

The institution is also the regulator and supervisor of the financial system and prescribes broad parameters of banking operations within which the country's banking and financial system functions. Objectives are to maintain public confidence in the system, protect depositors' interest and provide cost-effective banking services to the public. The Banking Ombudsman Scheme has been formulated by the Reserve Bank of India (RBI) for effective addressing of complaints by bank customers. The RBI controls the monetary supply, monitors economic indicators like the gross domestic product and has to decide the design of the rupee banknotes as well as coins.

Manager of exchange control

The central bank manages to reach the goals of the Foreign Exchange Management Act, 1999. Objective: to facilitate external trade and payment and promote orderly development and maintenance of foreign exchange market in India.

Issuer of currency

The bank issues and exchanges or destroys currency and coins not fit for circulation. The objectives are giving the public adequate supply of currency of good quality and to provide loans to commercial banks to maintain or improve the GDP. The basic objectives of RBI are to issue bank notes, to maintain the currency and credit system of the country to utilize it in its best advantage, and to maintain the reserves. RBI maintains the economic structure of the country so that it can achieve the objective of price stability as well as economic development, because both objectives are diverse in themselves.

Developmental role

The central bank has to perform a wide range of promotional functions to support national objectives and industries. The RBI faces a lot of inter-sectoral and local inflation-related problems. Some of this problems are results of the dominant part of the public sector.

Related functions

The RBI is also a banker to the government and performs merchant banking function for the central and the state governments. It also acts as their banker. The National Housing Bank (NHB) was established in 1988 to promote private real estate acquisition. The institution maintains banking accounts of all scheduled banks, too.

There is now an international consensus about the need to focus the tasks of a central bank upon central banking. RBI is far out of touch with such a principle, owing to the sprawling mandate described above. The recent financial turmoil world-over, has however, vindicated the Reserve Bank's role in maintaining financial stability in India.

Proof Set: Coins of Rs 75, Rs 10, Rs 5, Rs 2 and Rs 1

See the Previous Post

No comments:

Post a Comment